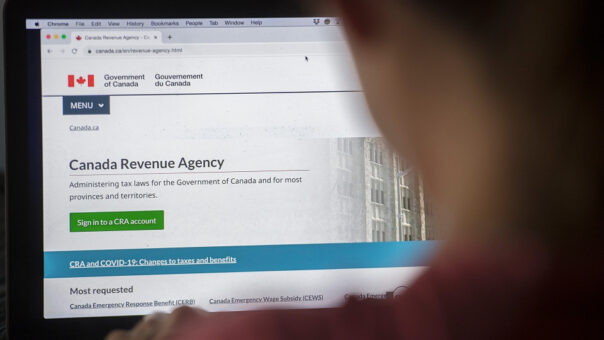

The Canadian Revenue Service (CRA) revealed to the media on February 17th local time that some users’ network accounts have been frozen in view of the discovery that some users’ encrypted information may be obtained by external “unauthorized” channels.

The Canadian Revenue Agency did not disclose how many users were affected.

Beginning February 16, some IRS network users found themselves unable to log in, with error codes “err 021” and “cer.019” displayed on the screen, and affected users all over Canada.

Because tax return information is real personal information and involves financial security, people complain through social media, worried that the epidemic subsidies they are applying for will not arrive on time or their information will be stolen.

The Canadian Revenue Service did not initially admit that this was a cybersecurity incident, but the Revenue Service said that they took measures to freeze the accounts of relevant users immediately after they found the problem, and that they are currently contacting and unfreezing accounts with the legitimate holders of these accounts.

In recent years, Canadian financial institutions, mobile operators, medical examination institutions, etc.

have all experienced user information leakage incidents.