In this world, we really can’t think of it, and no Americans can’t do it.

When I woke up, a tragic scene happened.

Tragedy, extreme tragedy!

One of Wall Street’s most watched stocks, Gamestop, closed at $197.44, plummeting 43.18%!

Please note that this is the closing.

There were 17 meltdowns in the session, which plummeted to 67.70% at one time, but also soared by nearly 40% at one time.

More importantly, this is only a one-day transaction.

The previous day, the game station soared by 134.84%.

If you put it a little longer, the stock’s peak has soared by 2,500% in just 2021. See some Americans sighing online: If I had bought $100,000 a year ago, I could have $10 million now, but unfortunately I didn’t!

Work miracles.

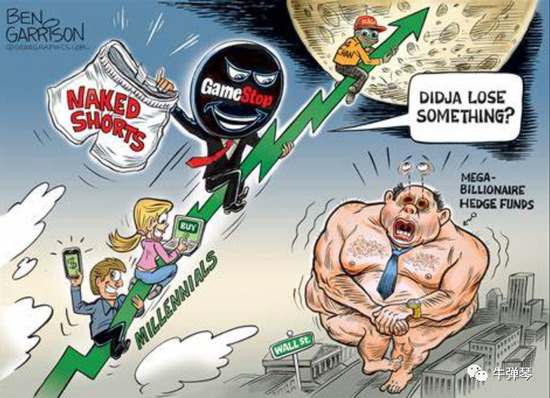

But behind this stimulus is a rare and historic scene, young retail investors vs. hedge funds. But this time, hedge funds were killed to throw away their helmets and even jumped off buildings in despair.

Why is it a game post station?

This is an American video game retailer, which is the youthful memory of many people. Unfortunately, the company’s business is not good, and it lost nearly 800 million US dollars in 2019. In the era of the prevalence of online games, game post stations still mainly rely on stores to sell game software, but also sell joysticks, headphones, keyboards, etc., which is a “living antique”.

Until the summer of 2020, the stock price of Game Post Station was still hovering around $5. Not long ago, the management of the company tried to change the traditional sales model and embrace the Internet. So the stock price gradually rose, and by the last day of last year, the stock price was $18.84.

Is the game station worth this price?

Wall Street thinks it’s not worth it.

Since it’s not worth it, short it. As a hedge fund of Wall Street vultures, it naturally does not miss such a good opportunity, so it shorts heavily, betting that the price of the game station will plummet.

Looking at the data, the proportion of game post stations once sold reached an incredible 140%. That is to say, the stock has been repeatedly shorted, and hedge funds hope to earn an IQ tax.

This obviously stimulates many young retail investors in the United States. Their youth memories, their optimistic stocks, hedge funds are selling large shorts. Therefore, in various stock market forums on the Internet, especially in the “Wall Street Casino” forum on the Reddit platform, young retail investors cheered for each other, encouraging the purchase of game post station stocks and killing these hedge funds.

As a result, it really washed Wall Street!

Many people have great power, and the power of retail investors cannot be ignored. The stock price of game post stations has been soaring recently.

On January 13, it soared by 57.39%;

On January 14, it soared by 27.10%;

…

On January 22, it soared by 51.08%;

On January 25, it soared by 18.12%;

On January 26, it soared by 92.71%;

On January 27, it soared by 134.84%…

Ant soldiers vs. Wall Street vultures. Yesterday was tragic, but this is only the beginning!

As a result, the higher the stock price rises, the more hedge funds short; but several times and dozens of times soar, shorting will explode. In order to stop the loss, hedge funds finally had to spend several times to buy stocks, which led to a further price surge.

Many hedge funds have hit this stock. According to statistics, investors have lost $91 billion this year just because of shorting game stations.

For example, Xiangli, a well-known short-selling agency, also predicted on January 19 that the stock would plummet by $20. But this stimulated investors’ buying mood. Finally, Xiang said that he would no longer speak.

Melvin Capital Fund is the worst, and recently had to accept two other blood transfusions of $2.75 billion. According to expert analysis, this may have avoided the largest bankruptcy of hedge funds in history. You know, 20 years ago, Long-Term Capital Management closed down, which triggered shocks in global financial markets.

It’s an eye-opener.

I saw an analyst interpret it like this: “Generally speaking, the traders in the stock market game are company executives in skyscrapers. This time, a group of young people sitting on the sofa at home manipulated the stock market. And this time, this kind of small investors plotting against the “short selling black forces” is really unheard of.

Indeed, I have never heard of it.

In the past, hedge funds were all about each other, let alone Wall Street vultures; but this time, the result was that the hedge fund was severely hanged and had to cut meat to close the position, and the American retail flag won…

Why is this so?

In my opinion, at least three o’clock.

First, it must be seen that the Internet has a strong mobilization capacity.

It is worth noting that things fermented in the online stock speculation forum, and young retail investors encouraged each other. Just now I took a look at the volume of each transaction, which is hundreds or even a few shares, which are undoubtedly retail investors. Emotions are contagious, young people are more likely to coax, and the Z era eventually formed a powerful ant soldier. In front of the ocean of young American investors, hedge funds have to surrender.

In fact, the current turmoil in many countries, and even the Trump phenomenon in the United States, reflect the strong mobilization ability of the Internet. Even if there is no real organization, the power of emotion is enough to shake the whole society. The current flood of liquidity in the United States, and many young people stay at home and do nothing, which contributes to the incident.

Second, we should also see the dissatisfaction of young Americans and hatred of Wall Street.

Why do you aim at the game post station? First, this is the youthful memory of many Americans; second, it shows the hatred of young people for Wall Street. Or it can be said that this is a financial version of “Occupy Wall Street”. I see that some Americans analyze, “This is a struggle for generations, against those rich, and then give to poor young people born in the millennium.”

People hate Wall Street’s greed. In relevant online forums, young people complain that it is unfair to young Americans to control too much wealth. Under the epidemic, they are more dissatisfied and need to vent more. The game post station with emotional memory has become the best exit.

Third, new forms of confrontation have just begun.

Is this a flash in the pan? Not necessarily. However, from the current point of view, the stock price of the game post station has completely divorced from the fundamentals. Don’t forget, Buffett has a famous saying: You don’t know who is swimming naked until the tide is low. The collective excitement of young American retail investors will certainly end with tears of some people. They expect to change their fate and fight back through new forms, but in the end they lose the worst, which in turn exacerbates the hatred of Wall Street in the Z era of the United States…

However, in the short term, the fierce killing continues. I just saw that after closing down 67.70%, the after-market trading of the game post station surged by about 70% again.

2021 has just begun, and we have witnessed too many things that we dared not think about before.