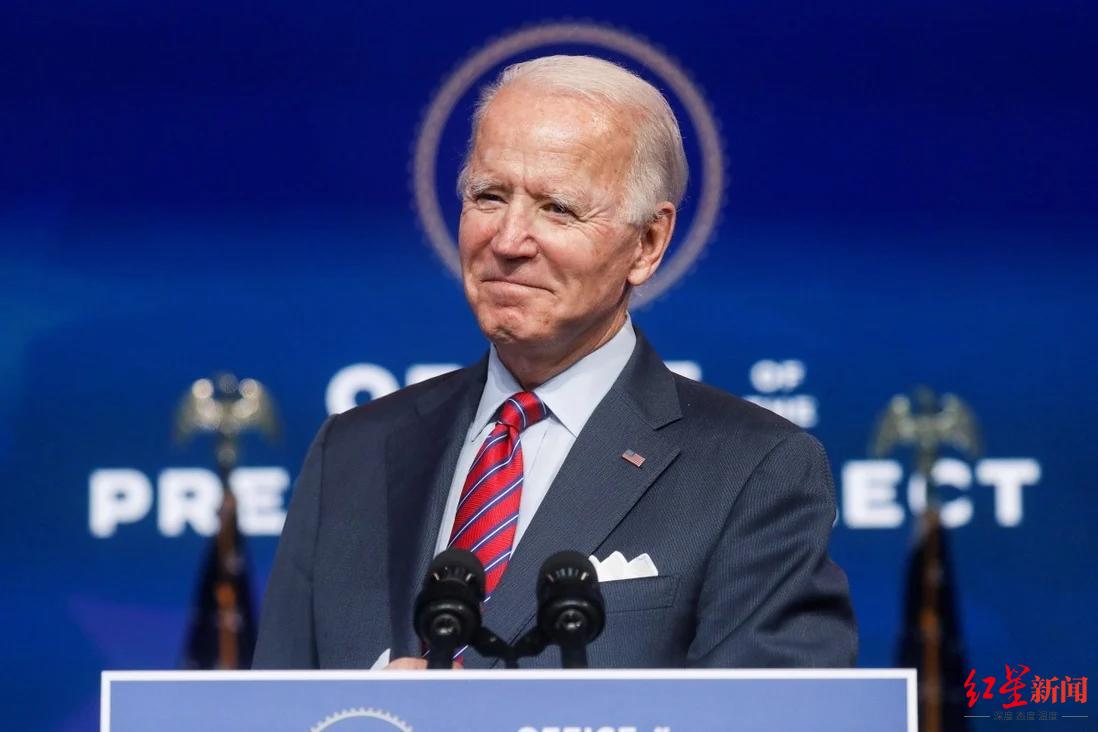

December 22 that the rich in the United States are rushing to make large transactions by the end of the month, trying to complete the deal before President-elect Joe Biden and congressional Democrats take measures to raise taxes or plug leaks next year.

Some consultants said that they were busier than ever in the last few weeks of the year, especially to help customers (while they can handle it) and transfer wealth tax-free to the next generation. Appraisers who play a vital role in the valuation of assets used in real estate planning strategies are very busy.

Jonathan Miller, president of Miller-Samuel Real Estate in New York, said that the number of applications for real estate valuation has quadrupled. By the end of November, he had to start to decline some customers.

Miller said: “At present, physically speaking, we can’t handle all year-end deadline business. We started this business after the Thanksgiving holiday and the volume of business is very frustrating.

According to the report, the enthusiasm at the end of the year surprised many advisers because Republicans performed better than many people expected in the congressional election. The results suggest Biden may struggle to live up to his campaign promise to collect trillions of dollars in new taxes from the rich.

Still, tax reform is still possible in 2021, and the Biden administration may try to fill the many loopholes that make the American heritage tax and gift tax easy to avoid.

The report also said that the 2017 Republican tax law signed by President Donald Trump doubled the amount of wealth inherited by the rich without paying inheritance tax and gift tax. This year, the amount of personal inheritance tax and gift tax inheritance amount reached $11.58 million, and the couple’s inheritance tax and gift tax inheritance tax exemption. The commitment amount is $23.16 million. But the relevant terms will expire in 2026, which also provides a reason for the rich to act early.

The main reason why the rich took action by December 31 is that the tax reform introduced under Biden’s presidency may be traced back to early 2021. But many consultants now tell clients that this possibility seems less at present.

But Laura Zwick, head of private customer service at the law firm Greenberg-Grasque in Los Angeles, said she’s busier than ever, and in the weeks after the election, a staggering number of new clients came to seek to close the deal this year.