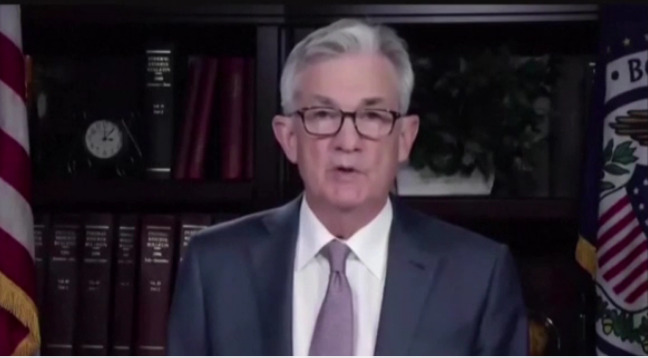

The chairman of the Federal Reserve reiterated that the economy still needs stimulus support, and the labor market is still far from full recovery.

Federal Reserve Chairman Powell said on Wednesday local time that the Federal Reserve will continue to support the U.S. economy through low interest rates and large purchase of assets. He stressed that the labor market is still affected by COVID-19.

Speaking at the New York Economic Club that day, Powell reiterated his view that “patience and relaxed monetary policy stance” would be an important factor in restoring the economy to a healthy state, in which workers, especially low-income groups, can find jobs. The chairman of the Federal Reserve also called for the government to increase fiscal support for the economy.

Monetary policy alone is not enough to restore the labor market to full vitality.” This will require the commitment of the whole society, including contributions from the government and the private sector. Many individuals and families need support in the new economic environment after the pandemic, as do small businesses, which will help them contribute and share the benefits of economic prosperity.” He said.

The U.S. unemployment rate fell to 6.3% in January from 6.7% in December, the U.S. Department of Labor said Friday. In February 2020, before the outbreak of COVID-19, the unemployment rate in the United States was 3.5%, which was at a low in nearly 50 years.

The updated economic outlook forecast of the Federal Reserve shows that most Fed officials expect the unemployment rate to be close to the level at the beginning of last year until 2023.

To mitigate the impact of the epidemic, the Federal Reserve last year took a series of unconventional measures to stabilize the market and support the economy, cut short-term interest rates to near zero, launched a series of emergency loan programs, and purchased U.S. Treasury bonds and mortgage bonds on a large scale.

The U.S. government has introduced two rounds of relief bills, and now the Biden administration and congressional Democrats are pushing forward a new round of $1.9 trillion stimulus plan, which has also aroused Republicans’ doubts about the high federal debt.

Powell has previously said that the debt level of the United States is “far from unsustainable” and that it is better to support the economy too much than to do too little.

In his speech Wednesday, Powell noted that since the outbreak, the Fed has been worried about the long-term impact of the virus on the labor market, while also weakening the economy’s ability to recover.” As can be seen from the previous expansion cycle, it may take many years to reverse this damage. He said.

Powell said the current unemployment rate underestimates the actual impact of the epidemic, and if the statistics have left the labor market and those whose employment conditions are misclassified, the “real” unemployment rate may rise to nearly 10% in January.

Data released this week by the New York Fed show that low-income groups have been the most affected during the current round of the epidemic, especially in jobs close relationships with others, such as bars, restaurants, shops, entertainment places and hotels.

Larry Summers, a former U.S. Treasury Secretary, and many economists worry that excessive fiscal support for the economy will lead to an inflation outbreak, and they want the Biden administration to reduce the size of the relief package. Powell is not worried about this, believing that inflation will not rise “largely or continuously” at present.

As the economy reopens, the price increase caused by the increase in spending is unlikely to continue. Over the past three decades, the inflation rate has been much lower and more stable than before.

The chairman of the Federal Reserve said that a strong labor market is a worthwhile goal. There is still a long way to go before such a goal.” There is every reason to expect that the labor market could have strengthened further without causing a worrying inflation rise.

My colleagues and I are firmly committed to doing everything we can to promote full employment.” He said.

Powell defended the Fed’s monetary policy stance, reiterating that the Fed would not consider raising interest rates even if inflation temporarily exceeded 2%.

He said the Fed needs to see “substantial progress” on employment and inflation targets before cutting the size of $120 billion a month in asset purchases.